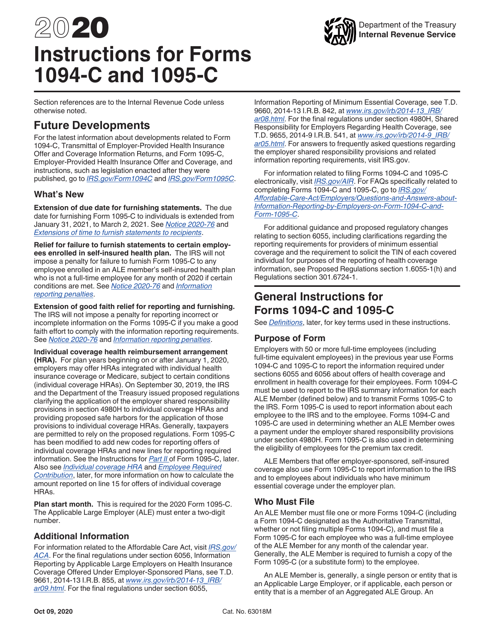

The IRS released draft instructions for the 16 1094C and 1095C Forms The Forms were issued earlier in the summer There are minimal changes to the forms for the 16 filing year, but the IRS did provide some clarifications in the draft instructions Some of the changes will require additional information from employers Instructions The deadlines to furnish statements to individuals and to file with the IRS have been updated from 17 to 18 Consistent with the changes to Form 1094C, references to the Section 4980H transition relief have been removed1095 c instructions 1921 Fill out documents electronically using PDF or Word format Make them reusable by making templates, include and complete fillable fields Approve forms with a lawful digital signature and share them by way of email, fax or print them out Save files on your PC or mobile device Increase your efficiency with powerful solution?

Ez1095 Software How To Print Form 1095 C And 1094 C

Form 1094-c instructions 2018

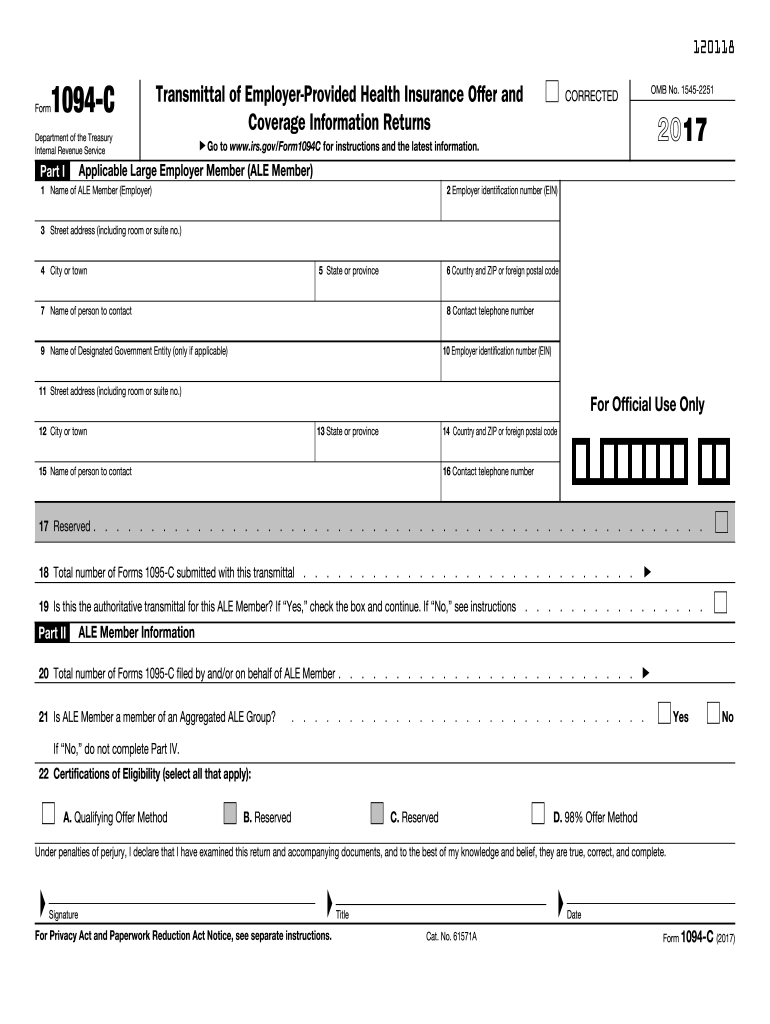

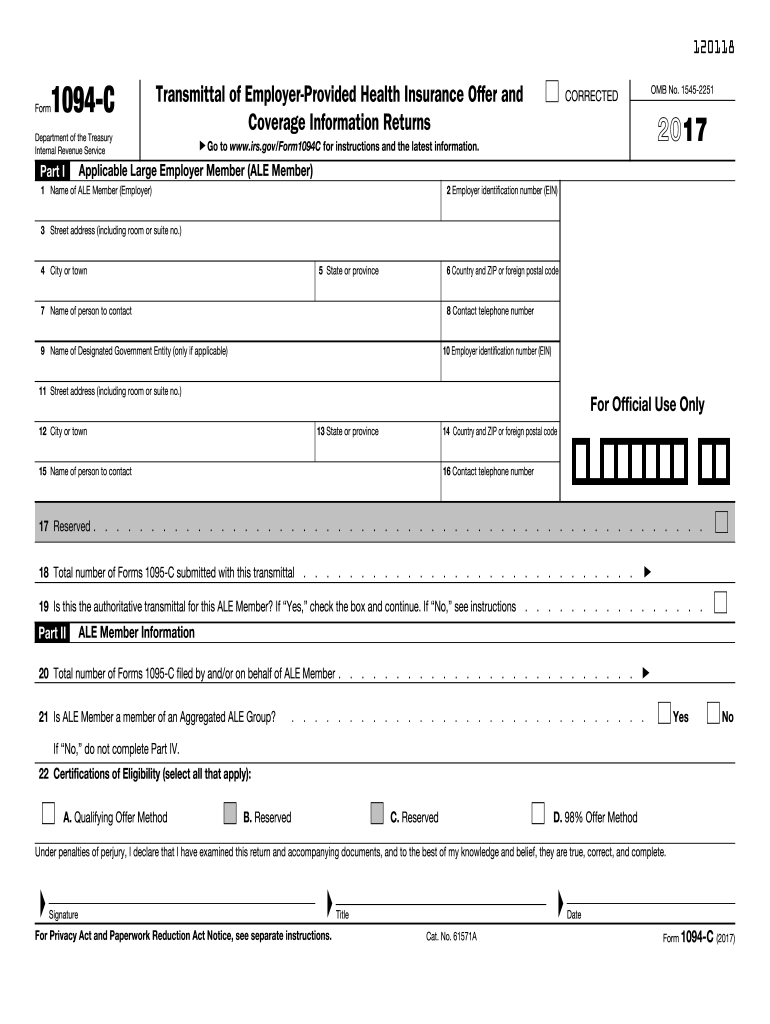

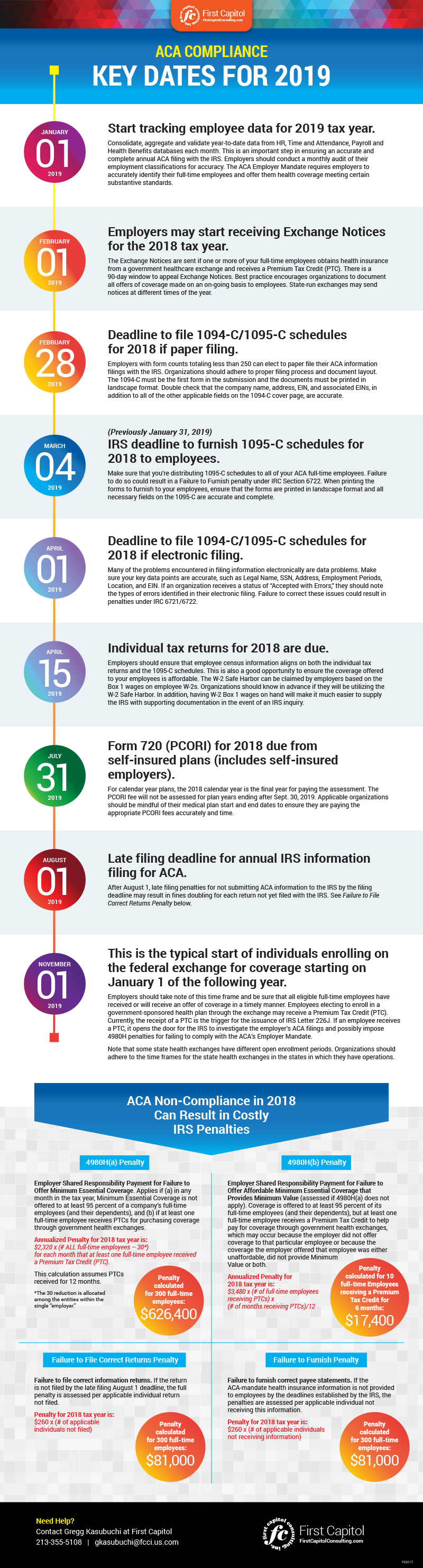

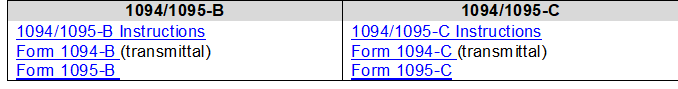

Form 1094-c instructions 2018- 18 Form 1094C/1095C Instructions – Penalties for reporting failures and errors will increase to $270 per violation up to an annual maximum of $3,275,500 Please note Penalty limits apply separately to IRS information returns and individual statements 1094C/1095C Deadlines Form 1095C must be sent out to employees by The IRS released draft instructions for both the 1094B and 1095B forms and the 1094C and 1095C forms and the draft forms for 1094B, 1095B, 1094C, and 1095C There are no substantive changes in the forms or instructions between 18 and 19

17 Form Irs 1094 C Fill Online Printable Fillable Blank Pdffiller

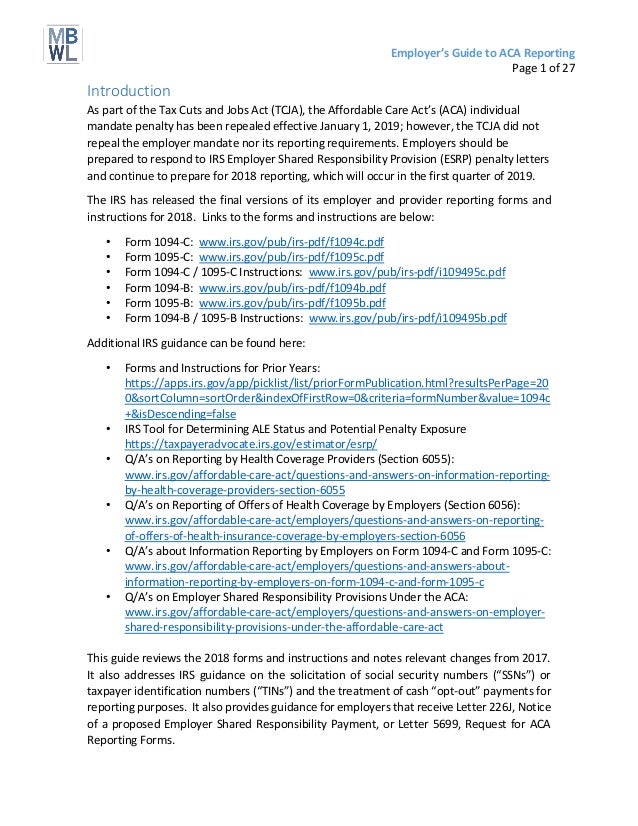

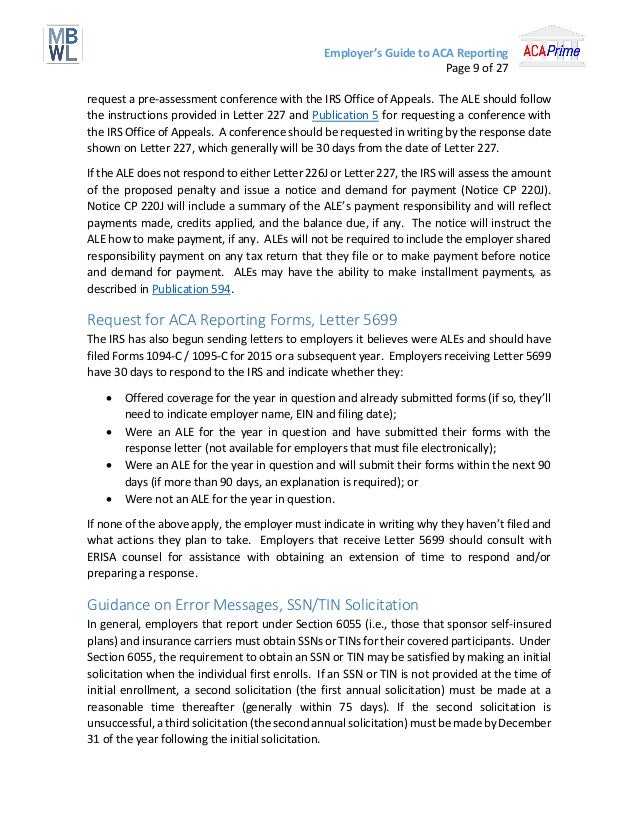

Mailing Instructions for Filing Paper Forms 1094C and 1095c Here are some general tips for employers who wish to file their Forms 1094C and 1095C by mail Do not paperclip or staple the forms together Check for the correct IRS address Postal regulations require all forms and packages to be sent by FirstClass MailA MAACA, C Vice President Director of HR Tech & Outsourcing Locton Benet roup bmandacina@locktoncom Many employers working to accomplish Affordable Care Act (ACA) reporting are puzzled by Line 22 on Form 1094C That line asks the employer whether it has used the "Qualifying Offer Method" or the "98% Offer Method"Forms 1094C and 1095C are most likely the cause of incorrect penalty assessments The Forms 1094C and 1095C are the forms the IRS uses to calculate ESRP assessments • If you need to make corrections to your filings, the IRS specifically states not to submit corrected Forms 1094C or 1095C You can make corrections in your response

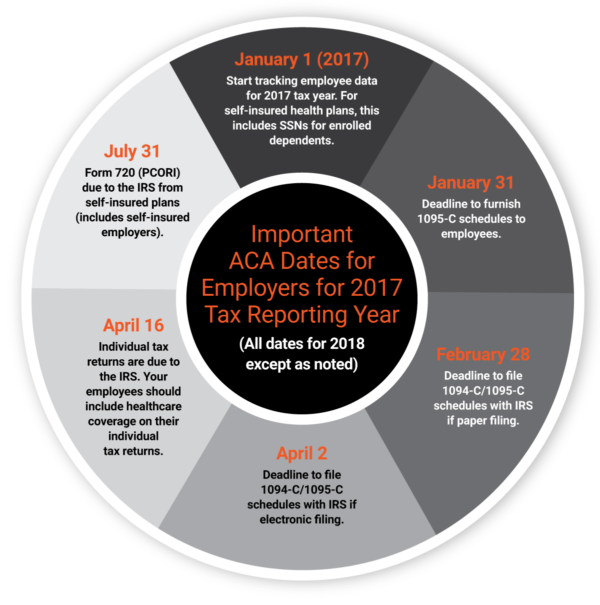

The IRS released the draft instructions to the Forms 1094C and 1095C on While many, including us as discussed in our previous article, expected some changes as a result of the Individual Mandate being reduced to $0 beginning in 19, the draft instructions were virtually identical compared to the 18 iteration of the instructionsFor 18, the deadlines are • — Send Form 1095 copies to recipients/employees • — Paper filing of 1095s (and 1094 transmittals) to IRS • — Efiling of 1095s (and 1094 transmittals) to IRS Employers missing the filing deadlines with the IRS for forms 1094C and 1095C or who file 18 Instructions for Forms 1094C and 1095C 1095C Form 1094C Form To further assist our clients, Kistler Tiffany Benefits' Director of Compliance Services Scott Wham, JD, also recently recorded a webinar that outlines 18 1094C/1095C

Forms and Instructions The IRS has released the 18 Forms 1094C, 1095C and form instructions There are no significant changes to the forms or instructions, however there are a few minor formatting changes on Form 1095C The IRS released the final drafts of the Forms 1094C, 1095C, 1094B and 1095B, as well as Instructions for the Cforms and BformsThese final editions reflect the previously issued drafts for the ACA 18 calendar year reporting Form 1094C is a coversheet that must accompany every Form 1095C a reporting employer sends to the IRS 36 37 If you find yourself sending a Form 1094C, without attaching Forms 1095C, to the IRS, you are doing it wrong 37 38

Download Instructions For Irs Form 1094 C 1095 C Pdf Templateroller

Form 1094 C Instructions For Employers What You Need To Know

Forms 1094 & 1095 Reporting youR Responsibilities employeR Fully insuRed plan selFinsuRed plan Single employer (including employers in a MEWA) Controlled Group Employer in multiemployer (union) plan Government Unit » Employer completes Form 1094C and 1095C, except for Form 1095C Part III, which is completed by the insurer1095c instructions 1921 Complete forms electronically working with PDF or Word format Make them reusable by generating templates, include and fill out fillable fields Approve forms with a lawful electronic signature and share them through email, fax or print them out Save blanks on your computer or mobile device Enhance your efficiency with powerful solution? Instructions for Form 1094C and 1095C From the 19 Instructions for Forms 1094C and 1095C Purpose of Form Employers with 50 or more fulltime employees (including fulltime equivalent employees) in the previous year use Forms 1094C and 1095C to report the information required under sections 6055 and 6056 about offers of health

Irs Roundup What You Need To Know About The Irs And The Affordable Care Act The Aca Times

Irs Releases Draft Forms And Instructions For 18 Aca Reporting Brinson Benefits

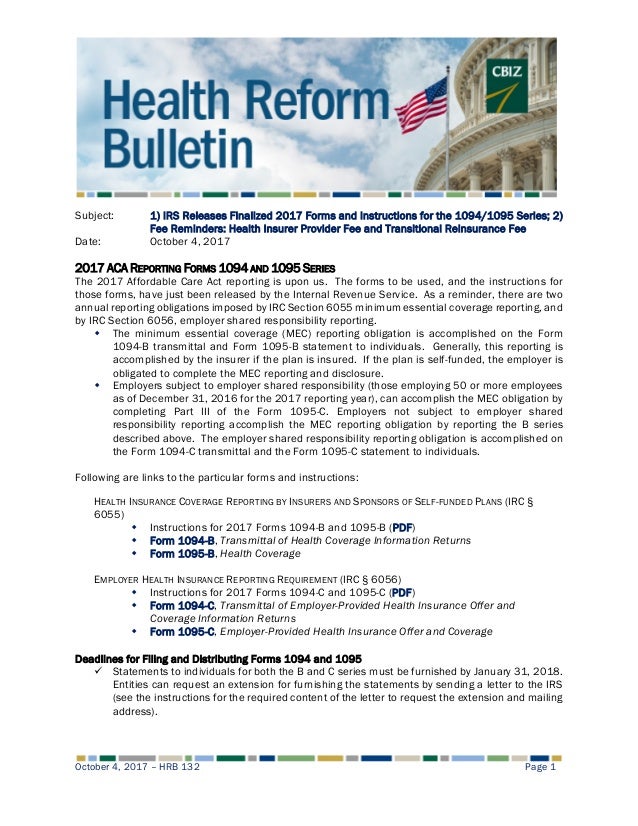

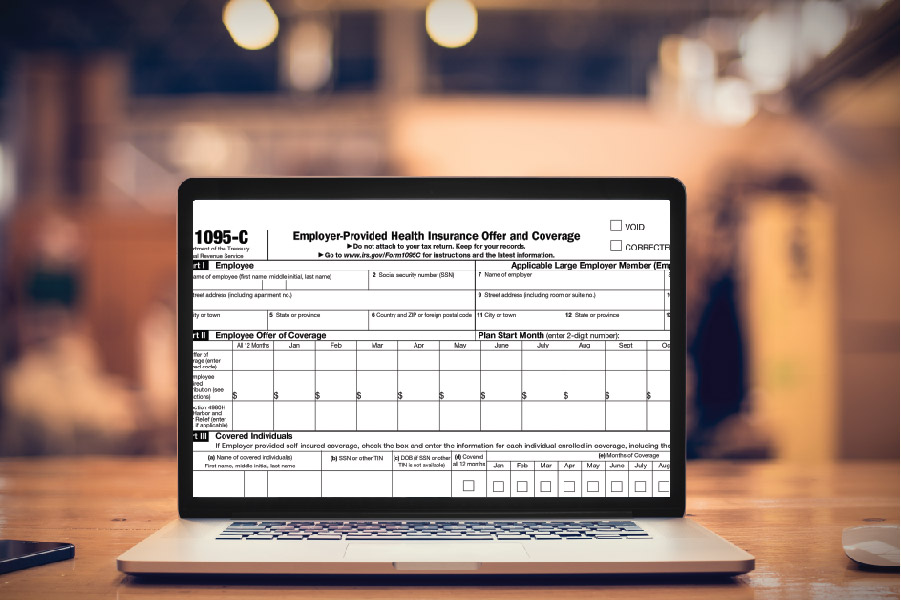

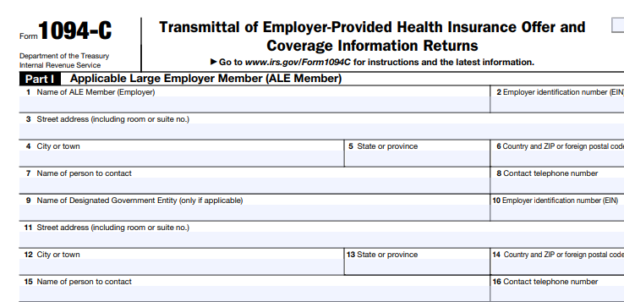

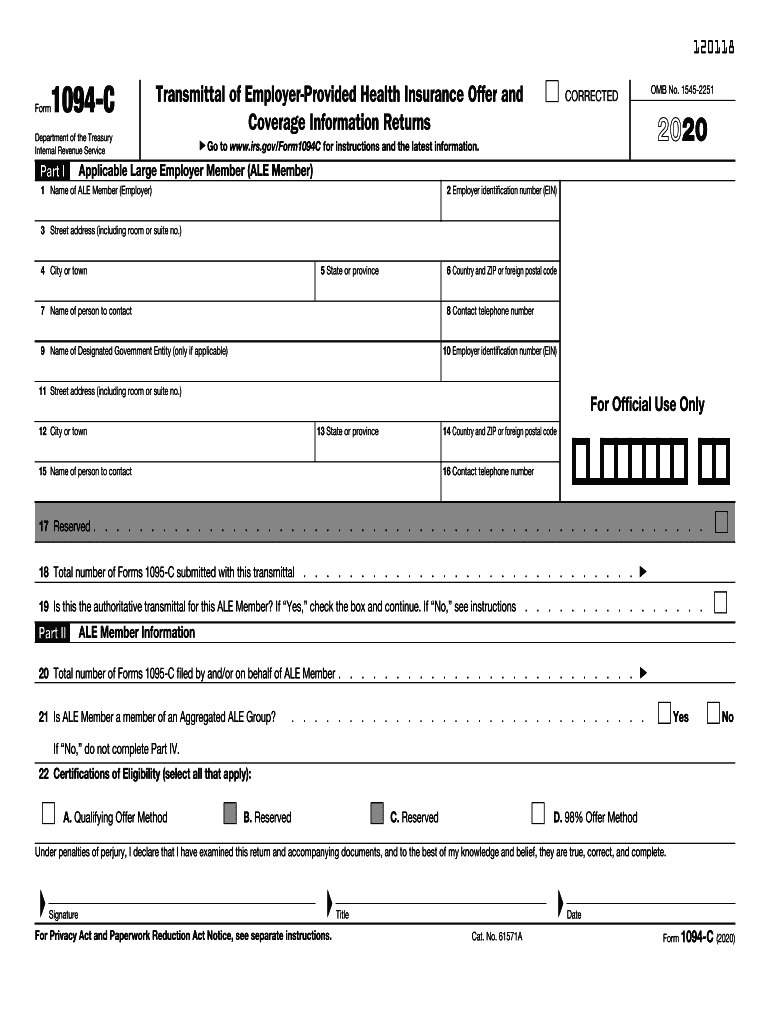

Form 1094C is used in combination with Form 1095C to determine employer shared responsibility penalties It is often referred to as the "transmittal form" or "cover sheet" IRS Form 1095C will primarily be used to meet the Section 6056 reporting requirement, which relates to the employer shared responsibility/play or pay requirement Used for Reporting in Early 18 The IRS has released the final 17 Instructions for Forms 1094B, 1095B, 1094C, and 1095C to help employers prepare for calendar year 17 Affordable Care Act (ACA) information reporting Employers will use the final versions of the forms and instructions in early 18 to report on health coverage offeredInstructions for both the 1094B and 1095B and the 1094C and 1095C were released, as were the forms for 1094B, 1095B, 1094C, and 1095C There are no substantive changes in the forms or instructions between 17 and 18, beyond the further removal of nowexpired forms of transition relief There is a minor formatting change to Forms 1095

2

Correcting Errors Reported By The Irs Is Just As Important As Filing

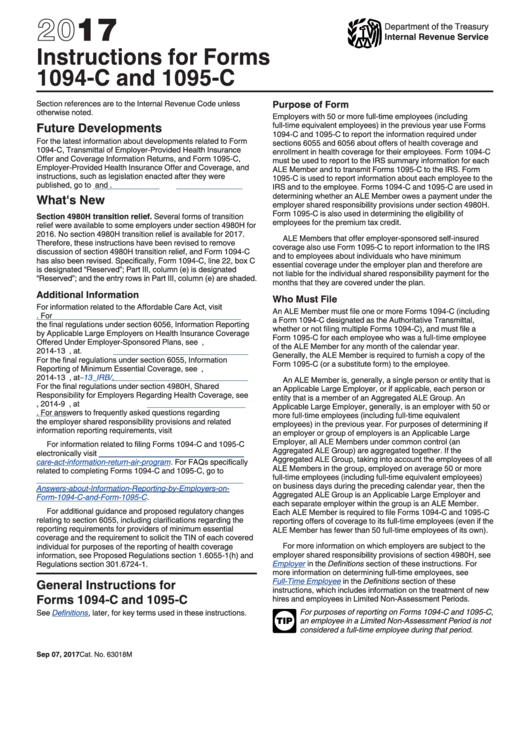

For 18 reporting (forms are due in early 19) 18 Form 1094C, EmployerProvided Health Insurance Offer and Coverage 18 Form 1095C, Transmittal of EmployerProvided Health Insurance Offer and Coverage Information Returns Instructions for 18 Forms 1094C and 1095C18 Instructions for Forms 1094C and 1095C Department of the Treasury Internal Revenue Service Section references are to the Internal Revenue Code unless otherwise noted Future Developments For the latest information about developments related to Form 1094C, Transmittal of EmployerProvided Health InsuranceIRS ISSUES ACA 18 FORMS 1094C AND 1095C, INSTRUCTIONS, AND 226J FOR 16 Robert Sheen 1 minute read The IRS has released the final 1094/1095C schedules and reporting instructions for the 18 tax year, to be filed and furnished in 19 You can find the Read More

Form 1094 C The Aca Times

2

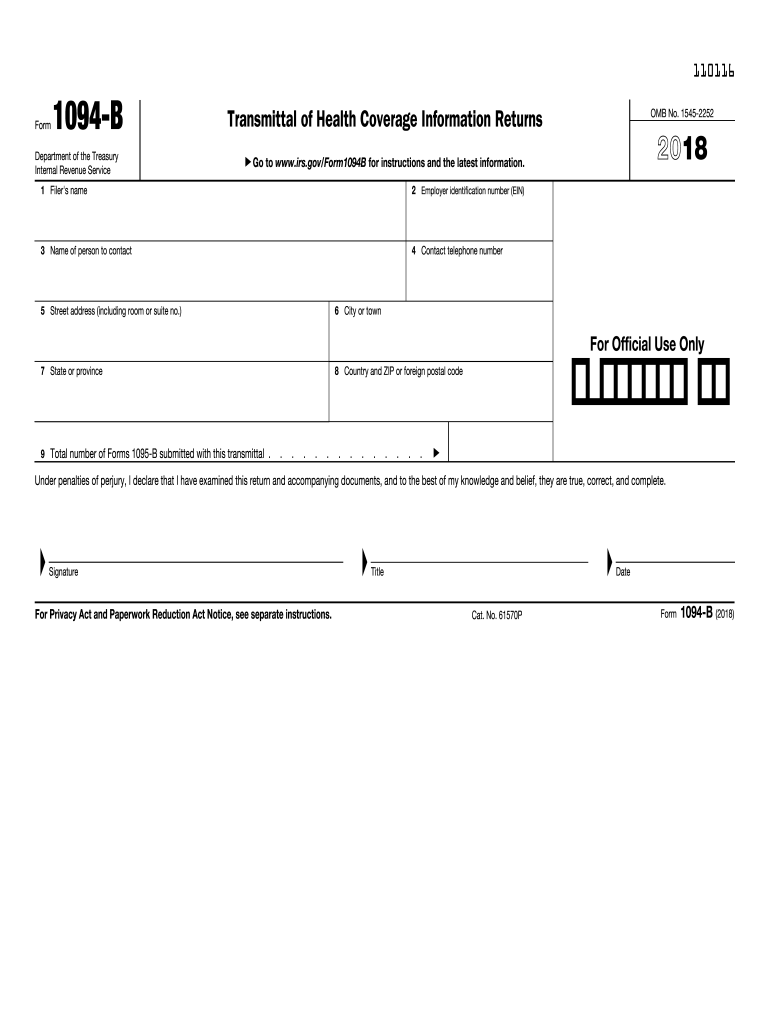

A Form 1094C must be filed when an employer files one or more Forms 1095C by Forms 1095C for some of its employees, provided that a Form 1095C is filed for each employee for whom the employer is required to file In All applicable large employers (ALE) must file Forms 1094C and 1095C with the IRS and furnish a copy of the 1095C to all fulltime employees The insurance carrier for a fully insured plan must complete Forms 1094B and 1095B Generally, only employers that are nonALEs with a selfinsured plan will complete Forms 1094B and 1095B The instructions to the Forms 1094C and 1095C "were released with minimal changes compared to the final instructions from 16," said Ryan Moulder, a LosAngeles based partner at Health Care

Irs Releases Final Forms And Instructions For 18 Aca Reporting

2

Example 1 Employer A, an ALE Member, files a single Form 1094C, attaching Forms 1095C for each of its 100 fulltime employees This Form 1094C should be identified as the Authoritative Transmittal on line 19, and the remainder of the form completed as indicated in the instructions for line 19, later Example 2 After a lengthy and unexplained delay, the Internal Revenue Service released drafts of the 19 Forms 1094C, 1095C and their corresponding instructions on The forms and reporting obligations are basically unchanged from 18 There had been speculation that reporting might be streamlined due to the repeal The 1094C must be filed with the Form 1095C, but it acts as a sort of cover sheet that sums up all the 1095Cs As stated above, the primary goal for the IRS with these forms is to determine whether you have satisfied the Employer Mandate, whereby you offer sufficient insurance If you don't satisfy the Employer Mandate, there are fines

17 Form Irs 1094 C Fill Online Printable Fillable Blank Pdffiller

2

This week, the IRS released draft copies of the Instructions for the 18 Forms 1094B/C and 1095B/C The Instructions will be used for completing 18 calendar year health care reform reporting The "What's New" section of the Form 1094B and 1095B Instructions states that health insurance issuers and carriers are encouraged (but notThe IRS has published the draft instructions for Forms 1094B and 1095B, as well as the draft instructions for 1094C and 1095C, to be used in conjunction with ACA filings for Tax Year 18 The following changes have been made to the 1094/1095B Instructions "Coverage under a section 1115 demonstration waiver program" has been removed from the list of MedicaidDownload Printable Irs Form 1094c, 1095c In Pdf The Latest Version Applicable For 21 Fill Out The Online And Print It Out For Free Irs Form 1094c, 1095c Is Often Used In Us Department Of The Treasury Internal Revenue Service, United

Download Instructions For Irs Form 1094 C 1095 C Pdf Templateroller

Irs Govform1095a Employer Provided Health Insurance Offer In Pdf

18 instructions form 1094c 17 1094c 1095c part iii How to create an eSignature for the 1094 c 17 pdf Speed up your business's document workflow by creating the professional online forms and legallybinding electronic signatures18 Form 1095C Instructions Form 1095C (18) Instructions for Recipient You are receiving this Form because your employer is an Applicable Large Employer subject to the employer shared resgnnsibility prwision n the Affordable Care Act This Form ID95—C ncludesOctober 18 The Internal Revenue Service ("IRS") has released the final 18 version of the Affordable are Act ("AA") Information Reporting forms, aka Forms 1094 and 1095 and instructions Applicable Large Employers ("ALEs")¹ are obligated to issue and file the 18 AA information returns Other than some formatting

Federal Tax Form 1094 B Fill Out And Sign Printable Pdf Template Signnow

Form Irs 1095 C Fill Online Printable Fillable Blank Pdffiller

Used for Reporting in Early 18 The IRS has released the final 17 Instructions for Forms 1094B, 1095B, 1094C, and 1095C to help employers prepare for calendar year 17 Affordable Care Act (ACA) information reporting Employers will use the final versions of the forms and instructions in early 18 to report on health coverage offered (or not offered) in the 17 calendar year Key IRS Releases ACA Forms, Instructions, and Guidance for 17 By Marshall Slaybod In October, the Internal Revenue Service (IRS) published updated versions of Affordable Care Act Forms 1094C and 1095C, as well as the instructions for how to complete the forms for tax year 17 Forms 1094C and 1095C are used by Applicable Large EmployersFinal 1094/5C Forms and Instructions The IRS has released final 16 Forms 1094C, 1095C and related Instructions to assist applicable large employers (ALEs) with satisfying information reporting obligations under IRS Code sections 6055 and 6056 Through these Forms, ALEs will report in early 17 offers of health

Datatechag Com Ag Web Docs How To file aca information returns Pdf

1095 C 1094 C Aca Software To Create Print E File Irs Form 1095 C

The IRS has released the final 1094/1095C schedules and reporting instructions for the 18 tax year, to be filed and furnished in 19 You can find the 18 instructions at this link The new 18 version of Form 1094C and Form 1095C are available at these links 18 Form 1094CFill Online, Printable, Fillable, Blank F1094c 19 Form 1094C Form Use Fill to complete blank online IRS pdf forms for free Once completed you can sign your fillable form or send for signing All forms are printable and downloadable F1094c 19 Form 1094C On average this form takes 35 minutes to complete The IRS has finalized Forms 1094/1095B (B Forms) and Forms 1094/1095C (C Forms), and related instructions, for the 18 tax year As a reminder, the B Forms are filed by minimum essential coverage providers (mostly insurers and governmentsponsored programs, but also some selfinsuring employers and others) to report coverage information in accordance with

trix Affordable Care Act Aca Forms

Www Irs Gov Pub Irs Prior F1094c 18 Pdf

Final Instructions for the Forms 1094C and 1095C Released with Few Changes – However IRS Enforcing the Employer Mandate Changes Everything The IRS recently released the final instructions to the Forms 1094C and 1095C with minimal changes compared to the final instructions from 17Use this stepbystep instruction to complete the 1094 c 18 form quickly and with ideal accuracy The way to complete the 1094 c 18 form online To start the blank, use the Fill & Sign Online button or tick the preview image of the form The advanced tools of the editor will guide you through the editable PDF templateAbout Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy & Safety How works Test new features Press Copyright Contact us Creators

Yes Employers Still Need To File Forms 1094 And 1095 Word On Benefits

Download Instructions For Irs Form 1094 C 1095 C Pdf Templateroller

Forms 1094C and 1095C As a refresher, Forms 1094C and 1095C are used by applicable large employers to satisfy their reporting obligations To correct information on the paper version of the original Authoritative Transmittal Form 1094C, the IRS instructions provide that employers should take the following stepsGenerally, you must file Forms 1094C and 1095C by February 28 if filing on paper (or March 31 if filing electronically) of the year following the calendar year to which the return relates For calendar year 18, Forms 1094C and 1095C are required to be filed by , or , if filing electronically

Mark These 19 Dates For 18 Aca Reporting Update The Aca Times

Aca Forms 1094 C And 1095 C And Reporting Instructions For The Aca Times

Download Instructions For Irs Form 1094 C 1095 C Pdf Templateroller

Irs Releases Final 18 Forms 1094 And 1095 And Related Instructions And Publications

1

Blog Health Care Coverage

2

2

trix Affordable Care Act Aca Forms

Irs Finally Finalizes 19 Forms 1094 And 1095 And Related Instructions

Irs Releases Forms 1094 1095 And Related Instructions Including New Rules For Ichra Reporting

Form 1095 C Guide For Employees Contact Us

3

Irs Releases Draft 1094 1095c Forms For Etc

Ez1095 Software How To Print Form 1095 C And 1094 C

Updated Irs Reporting Requirements Babb Insurance

Health Reform Bulletin 132 Irs Releases Finalized 17 Forms And In

2

2

What Are The Form 1094 C And 1095 C Requirements For Fully Insured Health Plans In

17 Forms 1094 1095 B C Released By Irs Medcost

2

Mbwl Employer S Guide To Aca Reporting 10 08 18

Form Irs 1094 C Fill Online Printable Fillable Blank Pdffiller

Www Chernoffdiamond Com Wp Content Uploads 18 10 Cdco Client Alert Irs Releases Final 18 Aca Forms Instructions 1094c 1095c October 18 Pdf

Download Instructions For Irs Form 1094 C 1095 C Pdf Templateroller

1

2

Static Fmgsuite Com Media Documents 22da7b7a Eccc 46d8 A33c Be2ac6c24da8 Pdf

Www Irs Gov Pub Irs Prior Ic 17 Pdf

Irs Releases Final 18 Aca Reporting Forms And Instructions Health E Fx

Download Instructions For Irs Form 1094 C 1095 C Pdf Templateroller

2

Irs Releases Forms 1094 1095 And Instructions For Early 19 Aca Reporting

1094 C 1095 C Software 599 1095 C Software

Overview Of 1095c Form

Download Instructions For Irs Form 1094 C 1095 C Pdf Templateroller

2

Irs Issues Aca 18 Forms 1094 C And 1095 C Instructions And 226j For 16 The Aca Times

Form 1095 A 1095 B 1095 C And Instructions

Download Instructions For Irs Form 1094 C 1095 C Pdf Templateroller

Irs Releases Final Forms And Instructions For 18 Aca Reporting

Download Instructions For Irs Form 1094 C 1095 C Pdf Templateroller

Irs Reveals Few Changes For Forms 1094 C 1095 C Blog Medcom Benefits

Vehi Org Client Media Files Ale Webinar Presentation Part Ii Examples10 3 18 Pdf

trix Affordable Care Act Aca Forms

Download Instructions For Irs Form 1094 C 1095 C Pdf Templateroller

Www Irs Gov Pub Irs Prior Ib 18 Pdf

Www Irs Gov Pub Irs Utl Instructions for ty18 predefined aats scenarios Pdf

An Overview Of Forms 1095 C And 1094 C Faq American Insurance In Lewiston Amp Moscow Idaho

Covered California Form 1095 B Unique New Instructions For Forms 1094 C And 1095 C An Infographic Models Form Ideas

Use This One Simple Tip To Avoid Irs Aca Penalties

Irs Issues Aca 18 Forms 1094 C And 1095 C Instructions And 226j For 16 The Aca Times

Irs Is Sending Aca Penalty Notices To Employers Employers Lawyers Blog Holland Hart Llp

Download Instructions For Irs Form 1094 C 1095 C Pdf Templateroller

State Individual Mandates Add To Employer Reporting Responsibilities Foster Foster

Accurate 1095 C Forms Reporting A Primer Integrity Data

Vehi Org Client Media Files Ale Webinar Presentation Part Ii Examples10 3 18 Pdf

Amazon Com 18 Complyright 1094 B Transmittal Forms Pack Of 50 Office Products

Mbwl Employer S Guide To Aca Reporting 10 08 18

Form Irs 1094 C Fill Online Printable Fillable Blank Pdffiller

Vehi Org Client Media Files Ale Webinar Presentation Part Ii Examples10 3 18 Pdf

Download Instructions For Irs Form 1094 C 1095 C Pdf Templateroller

Download Instructions For Irs Form 1094 C 1095 C Pdf Templateroller

Q Tbn And9gcr 5gdgcyy Qrw2p0flwcau1j8o8dk Tygaqmry3tdzdu25sm2w Usqp Cau

2

Form 1095 C 17 Fresh Irs Form 62 For 14 People Davidjoel Models Form Ideas

Vehi Org Client Media Files Ale Webinar Presentation Part Ii Examples10 3 18 Pdf

Irs Releases Final Forms And Instructions For 17 Aca Reporting California Benefit Advisors Johnson Dugan

Vehi Org Client Media Files Ale Webinar Presentation Part Ii Examples10 3 18 Pdf

Www Irs Gov Pub Irs Pdf P5165 Pdf

The Irs Releases Final 1094 C 1095 C Forms And Instructions For 18 Tax Year Foster Foster

Download Instructions For Irs Form 1094 C 1095 C Pdf Templateroller

Streamlined Aca Reporting Methods Newfront Insurance And Financial Services

Download Instructions For Irs Form 1094 C 1095 C Pdf Templateroller

Download Instructions For Irs Form 1094 C 1095 C Pdf Templateroller

Download Instructions For Irs Form 1094 C 1095 C Pdf Templateroller

2

Form 1095 A 1095 B 1095 C And Instructions

Form 1095 A 1095 B 1095 C And Instructions

Www Stephens Com Globalassets Insurance Webinars What Employers Need To Know About Irs Reporting In 19 Pdf

Instructions For Forms 1094 C And 1095 C 17 Printable Pdf Download

No comments:

Post a Comment